Here Are The Types Of Debt In Accounting

By. Fajar - 20 Jan 2025 (1).png)

kelolalaut.com In the world of accounting, debt refers to a company's obligations to other parties that must be settled in the future. Debt arises from past transactions, such as purchasing goods or services on credit, loans, or other liabilities. Debt is categorized into several types based on its nature, duration, and source. Here is an explanation of the various types of debt in accounting:

1. Current Liabilities

Current liabilities are obligations that must be settled within one year or within the company’s operating cycle, whichever is longer. This type of debt is often used to finance the company’s short-term operations. Examples of current liabilities include:

- Accounts Payable: Obligations arising from the purchase of goods or services on credit from suppliers.

- Taxes Payable: The company’s obligation to pay taxes that are due.

- Accrued Expenses: Expenses that have been incurred but not yet paid, such as employee wages or loan interest.

- Short-term Loans: Loans that must be repaid within less than one year.

2. Long-term Liabilities

Long-term liabilities are obligations with a repayment period exceeding one year. These types of debts are usually used to finance major investments or long-term projects. Examples include:

- Bonds Payable: Debt securities issued by the company to investors, with maturities exceeding one year.

- Mortgage Payable: Loans secured by fixed assets such as land or buildings.

- Long-term Loans: Loans from financial institutions with a repayment period longer than one year.

3. Contingent Liabilities

Contingent liabilities are potential obligations that might arise in the future, depending on the outcome of specific events or conditions. Examples of contingent liabilities include:

- Legal Obligations: Liabilities that may arise from unresolved lawsuits.

- Product Warranties: Obligations to repair or replace defective products within the warranty period.

4. Intercompany Liabilities

These debts occur between entities within the same corporate group, such as loans between subsidiaries or between a parent company and its subsidiaries.

5. Trade and Non-trade Liabilities

- Trade Liabilities: Obligations arising from the company’s core business transactions, such as purchasing merchandise.

- Non-trade Liabilities: Obligations arising from transactions outside the company’s primary operations, such as loans from third parties for non-operational purposes.

The Importance of Debt Management

Effective debt management is crucial for maintaining a company’s financial health. Here are some reasons why:

- Maintaining Liquidity: Companies must ensure they have sufficient funds to meet short-term obligations.

- Minimizing Interest Costs: Proper debt management can help reduce the burden of interest expenses.

- Building Trust: Creditors and investors are more likely to trust companies that manage their debt well.

Conclusion

In accounting, debt represents a company's obligations that must be settled in the future as a result of past transactions. Debt can be categorized into various types, such as current liabilities, long-term liabilities, contingent liabilities, intercompany liabilities, as well as trade and non-trade liabilities, each with distinct characteristics and purposes. Effective debt management is crucial for maintaining a company's financial stability. This includes the company's ability to ensure liquidity, minimize interest costs, and build trust with creditors and investors. By understanding the types of debt and strategically managing obligations, companies can support growth and sustain long-term operations.

If you are interested in our Cuttlefish Fillet / Cuttlefish Whole Cleaned / Cuttlefish Pineapple Cut / Cuttlefish Whole Round please do not hesitate to contact us through email and/or whatsapp.

The Dominance of Demersal Fish: The Strategic Export Potential of Indonesia’s Grouper and Parrotfish

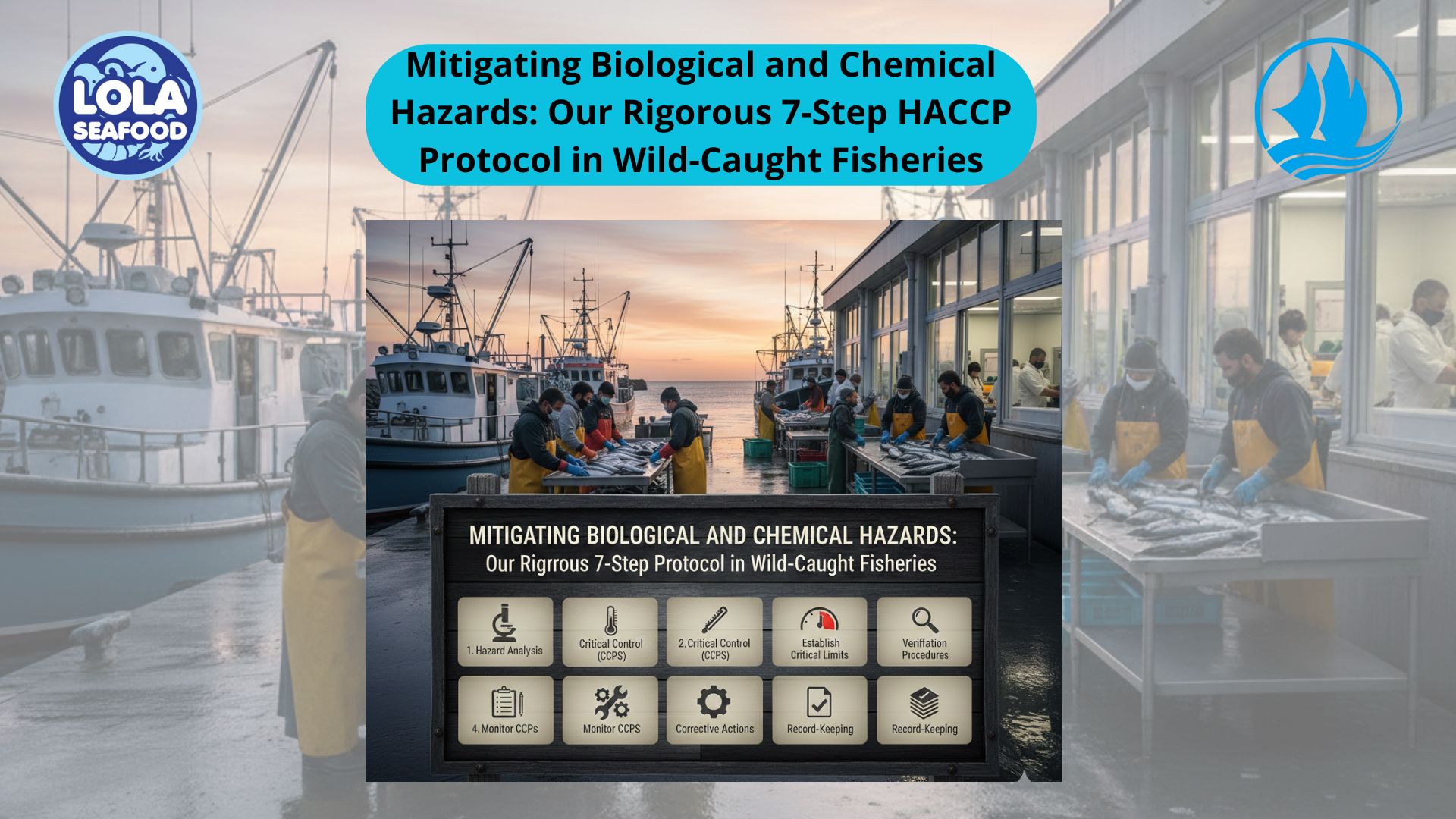

Mitigating Biological and Chemical Hazards: Our Rigorous 7-Step HACCP Protocol in Wild-Caught Fisheries

.jpg)