This Is Why To Understand Trade Payables And Non-Trade Payables For Companny

By. Fajar - 23 Jan 2025

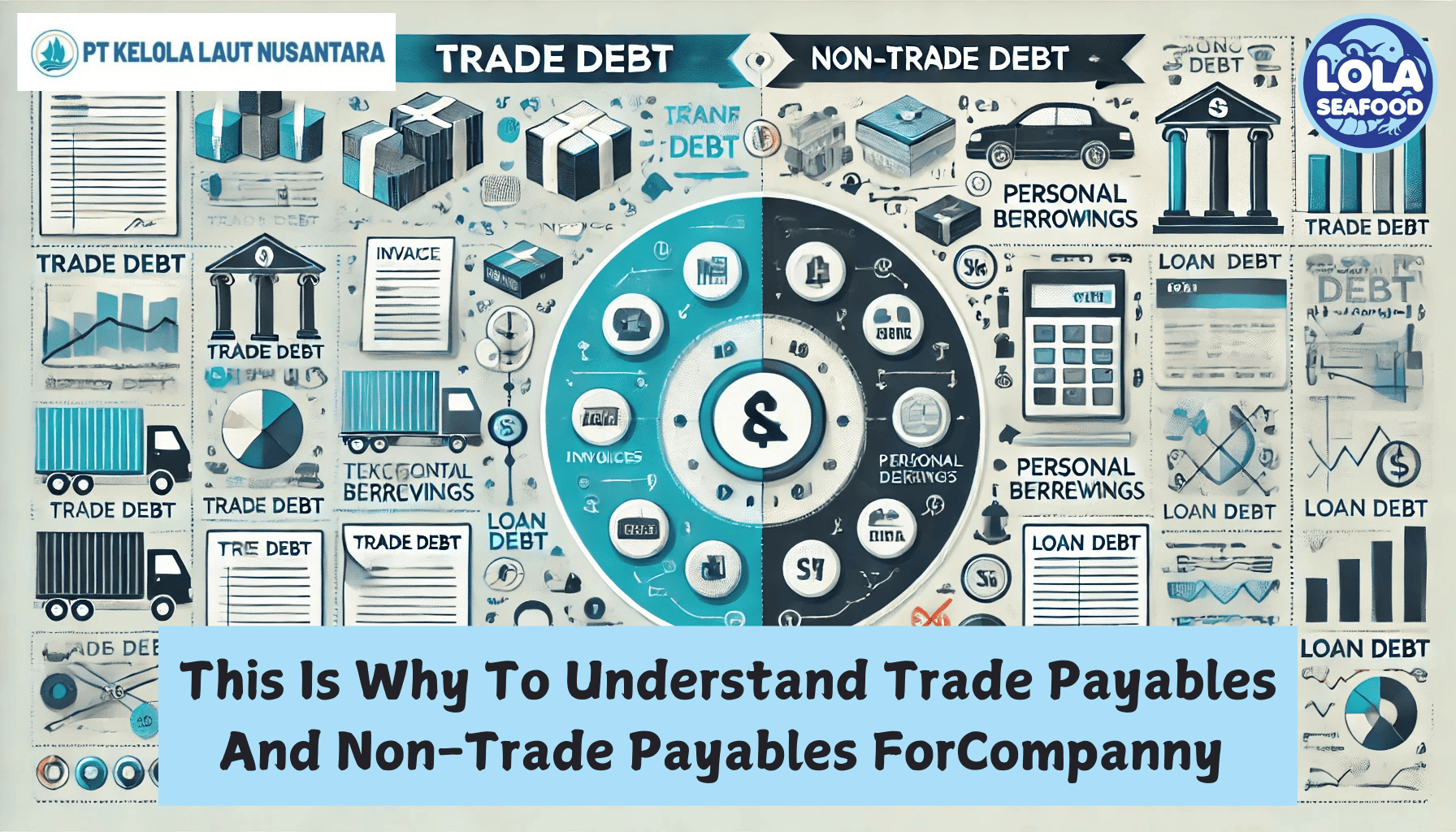

kelolalaut.com In the world of business and finance, the terms trade payables and non-trade payables frequently appear as part of financial statements or operational analyses. Both play a crucial role in financial management but have distinct characteristics and functions. This article will discuss the definitions, differences, and examples of these two types of payables.

Trade Payables

Definition

Trade payables are company obligations arising from the purchase of goods or services from other parties for operational purposes. These payables typically occur when a company buys goods on credit from suppliers.

Characteristics

- Short-Term Nature

Trade payables are generally due within a short period, typically 30 to 90 days.

- Related to Business Operations

These payables are directly related to the company’s core activities, such as purchasing raw materials, finished goods, or services needed for production and sales.

- No Collateral Required

Trade payables usually do not require specific collateral due to the trust between the company and its suppliers.

Examples of Trade Payables

- Purchasing raw materials for production.

- Buying goods from suppliers for resale.

- Logistics or transportation services used in business operations.

Non-Trade Payables

Definition

Non-trade payables are company obligations that are not directly related to core operational activities but still need to be settled. These payables often arise from transactions outside the scope of the company's primary business activities.

Characteristics

- Can Be Short or Long-Term

Non-trade payables can have either short-term or long-term durations, depending on the nature of the obligation.

- Not Always Related to Core Operations

These payables result from transactions or needs not directly connected to production or sales processes.

- May Require Collateral

Some non-trade payables, such as bank loans, often require collateral in the form of assets.

Examples of Non-Trade Payables

- Bank loans for business expansion.

- Unpaid employee salaries.

- Outstanding taxes.

- Payables to third parties for office facilities procurement.

Key Differences Between Trade Payables and Non-Trade Payables

|

Aspect |

Trade Payables |

Non-Trade Payables |

|

Relation |

Directly related to business operations |

Not always related to core operations |

|

Timeframe |

Generally short-term |

Can be short-term or long-term |

|

Source |

Transactions for purchasing goods/services for operations |

Transactions outside business operations |

|

Collateral |

Does not require collateral |

May require collateral |

Conclusion

Trade payables and non-trade payables are two types of obligations that play vital roles in a company’s financial management. Understanding the differences between the two helps businesses develop effective payment strategies and maintain financial stability. With proper management, companies can meet their obligations on time while maintaining good relationships with relevant parties, such as suppliers and financial institutions.

If you are interested in our Cuttlefish Fillet / Cuttlefish Whole Cleaned / Cuttlefish Pineapple Cut / Cuttlefish Whole Round please do not hesitate to contact us through email and/or whatsapp.

.jpg)

The Impact of HACCP-Based Integrated Quality Management Programs on the Quality and Competitiveness of Fresh Demersal Fish Products

and Employee Productivity on the Demersal Fish Processing Floor.jpg)

.jpg)