Safeguarding Fisheries Exports: The Role of Cargo Insurance

By. Wiwik Rasmini - 07 Jan 2025

kelolalaut.com The fisheries industry plays a crucial role in international trade, especially for countries that produce fisheries products like Indonesia. However, the process of shipping fisheries products to international markets often faces various risks. To mitigate these risks, a cargo insurance policy becomes a vital instrument.

What is a Cargo Insurance Policy?

A cargo insurance policy is an agreement that protects goods transported by sea, air, or land against the risk of damage or loss during transit. In the context of exporting fisheries products, this policy provides coverage to safeguard the value of the goods being shipped.

The Importance of Cargo Insurance in Exporting Fisheries Products

1. Protection Against Damage Risks

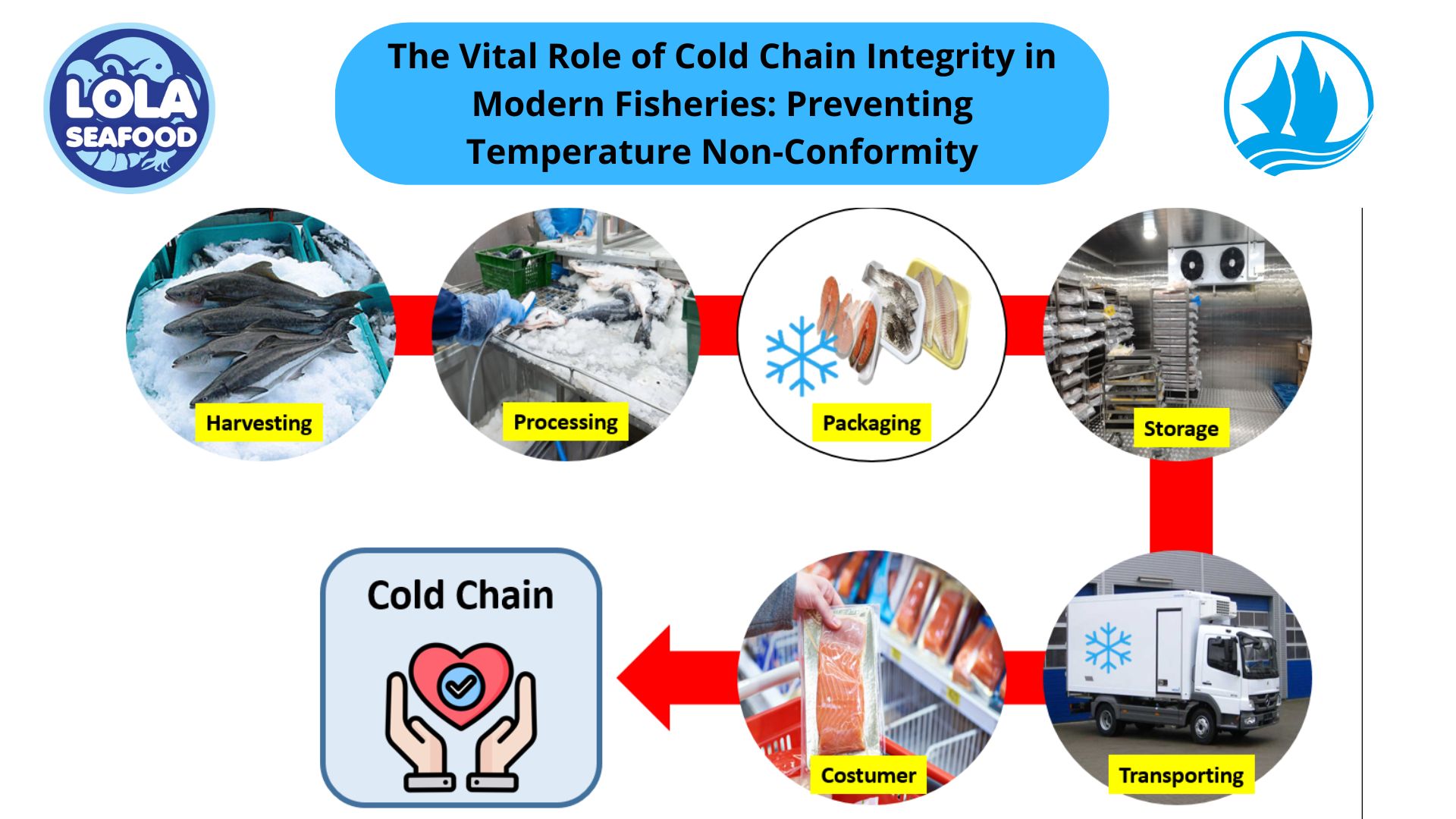

Fisheries products, such as fresh fish, shrimp, or other seafood, are highly perishable and prone to damage. These risks can be exacerbated by:

o Failure of refrigeration systems during transit.

o Improper handling of goods.

o Delays at ports.

A cargo insurance policy helps minimize financial losses resulting from such damages.

2. Protection Against Loss of Goods

The risk of losing goods during export may arise due to transportation accidents, piracy, or logistical errors. With an insurance policy, exporters can receive compensation for such losses.

3. Mitigating Financial Risks for Exporters

Without insurance, exporters must bear the costs of damage or loss themselves, which can significantly impact cash flow, especially for small and medium enterprises (SMEs).

4. Enhancing Trust with Trade Partners

International trade partners are more likely to trust exporters who have insurance protection. It demonstrates professionalism and the commitment of exporters to ensure the products arrive in good condition.

5. Compliance with International Regulations and Requirements

In many cases, buyers or international shipping companies require a cargo insurance policy as part of trade agreements. Having insurance helps exporters comply with these standards.

Benefits of Cargo Insurance Policies for Fisheries Product Exporters

1. Compensation for Losses

An insurance policy guarantees financial compensation for risks such as damage or loss of goods during transportation.

2. Reducing Stress and Uncertainty

With insurance, exporters can focus more on their core business activities without excessive worry about shipping risks.

3. Increasing Product Competitiveness

Exporters who can guarantee the safe delivery of their products are more trusted in international markets, enhancing the competitiveness of fisheries products globally.

4. Flexible Coverage Options

Cargo insurance policies offer various protection options that can be tailored to the needs of exporters, such as all-risk insurance or specific protection against certain risks.

5. Operational Efficiency

With insurance, exporters can avoid legal disputes or settlement processes that consume time and money if problems arise during shipment.

If you are interested in our emperor fillet skin on and emperor fillet skinless please do not hesitate to contact us through email and/or whatsapp

Optimizing Wild-Caught Fish Logistics: Maintaining Thermal Core Integrity During Long-Haul Transport

.jpg)

.jpg)

and Employee Productivity on the Demersal Fish Processing Floor.jpg)